Explain how GDP is measured according to the expenditure and income approaches

What will be an ideal response?

GDP can be measured using the expenditure approach or the income approach. The expenditure approach uses the streams of spending and adds together the total expenditure, or spending, on final goods and services. Thus the expenditure approach calculates the sum of consumption expenditure, investment, government expenditure on goods and services, and net exports. The income approach uses another of the circular flows to calculate GDP. The income approach adds together all sources of income and then incorporates a few additional adjustments. Thus the income approach calculates the sum of wages (which is the compensation of employees) plus the net operating surplus (which is the sum of interest, rent, and profit). The sum is "net domestic product at factor cost." To change this sum to GDP, which is calculated at market prices rather than factor costs, and which is the gross product rather than net product, indirect taxes are added and subsidies subtracted, then depreciation is added, and finally any statistical discrepancy is added.

You might also like to view...

Along a supply curve,

a. supply changes as price changes. b. quantity supplied changes as price changes. c. supply changes as technology changes. d. quantity supplied changes as technology changes.

When the nation of Mooseland first permitted trade with other nations, domestic producers of sugar experienced a decrease in producer surplus of $5 million and total surplus in Mooseland's sugar market increased by $2 million. We can conclude that

a. Mooseland became an exporter of sugar. b. the overall economic well-being of participants in the sugar market in Mooseland fell because of trade. c. consumer surplus in Mooseland increased by $7 million. d. the opening of trade caused the domestic demand curve for sugar in Mooseland to shift to the right.

Recall the Application about the incentives to install rooftop solar panels to answer the following question(s).According to the Application, the value of the federal tax credits equaled 30 percent of solar panel installation costs. If you purchase a rooftop solar panel for $20,000, then on the year you installed your solar panels, you should expect a decrease in your liabilities to the federal taxes by:

A. $6,000 B. $12,000 C. $15,000 D. $1,500

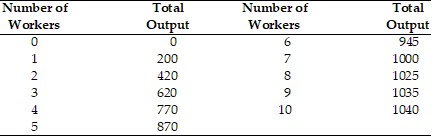

Refer to the above table. Suppose the firm hires 4 workers and the price of the good sold is $4. The marginal factor cost of labor must be

Refer to the above table. Suppose the firm hires 4 workers and the price of the good sold is $4. The marginal factor cost of labor must be

A. $150. B. $4. C. $600. D. $3080.