How much general business credit will he apply to the current year tax liability?

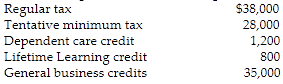

Ivan has generated the following taxes and credits this year:

The general business credit is applied to regular tax after application of the nonrefundable personal credits. However, the GBC cannot reduce regular tax below the tentative minimum tax so it is limited to $8,000. The remaining $27,000 can be carried back one year and carried forward 20 years.

You might also like to view...

Customer perceived value is defined as the difference between the ________ and the ________ of a product

A) actual value; retail value B) retailer's value; producer's costs C) actual costs; perceived costs D) perceived benefits; perceived costs E) actual benefits; actual costs

Expenses follow the same debit and credit rules as

A) Revenues B) Drawing Account C) Capital Account D) Liabilities

A security agreement must be filed or it is invalid

Indicate whether the statement is true or false

An advantage of a NOW account over a traditional checking account is that your money is more readily available to you

Indicate whether the statement is true or false.