McDonalds and many supermarkets offer vending machines in their stores that rent new movie releases for as low as $1.00 per day provided that they are returned in 24 hours before incurring a late fee

How can Netflix and Blockbuster compete against this type of service? Or is their something else going on there that doesn't first meet the eye?

Patrons who may take advantage of the $1.00 movie rentals were already buying a burger or doing their groceries. The opportunity cost to them is quite low to simply swipe their credit card and take their movie on the run. Netflix and Blockbuster may not necessarily be competing for the precisely the same customers. Netflix customers are willing to wait for their movies to arrive in the mail and Blockbuster customers apparently don't mind making the special drive over to the store to pick up their favorite movie. In either case the Netflix and Blockbuster customer did not choose to make a movie rental on a whim as the McDonalds and supermarket customer most likely did. In addition, the rental agreements are very different. Blockbuster and Netflix customers might also enjoy the convenience of being able to view the movie at their convenience. The supermarket video vending machines offer a lower price but tighter terms of service since the movies need to be returned in 24 hours.

You might also like to view...

Evidence from empirical studies of long-run cost-output relationships lends support to the:

a. existence of a non-linear cubic total cost function b. hypothesis that marginal costs first decrease, then gradually increase over the normal operating range of the firm c. hypothesis that total costs increase quadratically over the ranges of output examined d. hypothesis that total costs increase linearly over some considerable range of output examined e. none of the above

Assume that the expectation of declining housing prices cause households to reduce their demand for new houses and the financing that accompanies it. If the nation has highly mobile international capital markets and a flexible exchange rate system, what happens to the real risk-free interest rate and GDP Price Index in the context of the Three-Sector-Model?

a. The real risk-free interest rate and GDP Price Index remain the same. b. The real risk-free interest rate falls, and GDP Price Index falls. c. The real risk-free interest rate falls, and GDP Price Index stays the same. d. The real risk-free interest rate rises, and GDP Price Index falls. e. The real risk-free interest rate rises, and GDP Price Index rises.

John is trying to decide whether to expand his business or not. If he continues his business as it is, with no expansion, there is a 50 percent chance he will earn $100,000 and a 50 percent chance he will earn $300,000. If he does expand, there is a 30 percent chance he will earn $100,000, a 30 percent chance he will earn $300,000 and a 40 percent chance he will earn $500,000. It will cost him $150,000 to expand. If John decides to expand based on expected value, it means that:

A. the sum of expected earnings from expanding and from not must exceed $150,000. B. his expected earnings from expansion must exceed $150,000. C. the difference in expected earnings from expanding versus not must exceed $150,000. D. the difference in expected earnings from expanding versus not must not exceed $150,000.

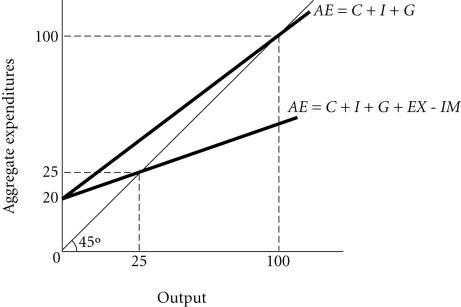

Refer to the information provided in Figure 34.1 below to answer the question(s) that follow. Figure 34.1Refer to Figure 34.1. If the economy is open and the government increases spending by 15, the new equilibrium output is

Figure 34.1Refer to Figure 34.1. If the economy is open and the government increases spending by 15, the new equilibrium output is

A. 81.25. B. 100. C. 112.50. D. 125.