Suppose the domestic and foreign interest rates are both initially equal to 3%. Now suppose the domestic interest rate rises to 5%. Explain what effect this will have on the exchange rate. Also explain what must occur for the interest parity condition to be restored

What will be an ideal response?

Domestic bonds will have a higher return causing the demand for the domestic currency to rise. The dollar will appreciate. It will continue to appreciate as long as the return on domestic bonds exceeds the return on foreign bonds. This immediate appreciation will equal an expected depreciation of the domestic currency that equates the expected returns. So, the dollar will appreciate by 2%.

You might also like to view...

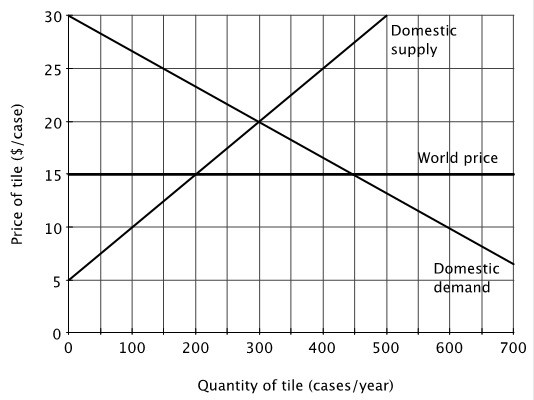

If Utopia has a closed economy, the price of tile is $________ per case, and if it has an open economy the price of tile is $________ per case.

A. 15; 10 B. 30; 15 C. 20; 15 D. 15; 20

If there is a decrease in market demand for a product exchanged in a perfectly competitive industry, it results in an industry contraction that will end when the product price is

A. less than the marginal cost faced by the firms. B. greater than the marginal cost faced by the firms. C. equal to the marginal cost faced by the firms. D. greater than the average cost faced by the firms.

Barbara Ehrenreich wrote about jobs in the ______ labor market; Beth Schulman wrote about jobs in the ______ labor market.

A. secondary; secondary B. primary; primary C. secondary; primary D. primary; secondary

A bank has a reserve requirement of 0.08. If it has demand deposits of $200,000 and is holding $4,000 in reserves:

A. the bank is not meeting its reserve requirement. B. all the bank's reserves are excess reserves. C. the bank is holding $2,000 in excess reserves. D. the bank could extend additional loans and still meet its reserve requirement.