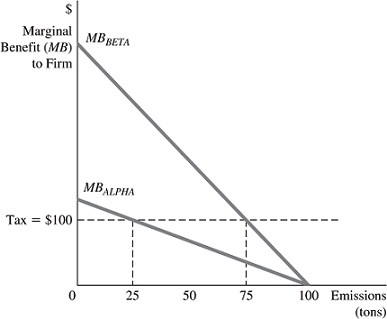

Refer to the information in Figure 16.5 below to answer the question(s) that follow. ?Figure 16.5Figure 16.5 shows the marginal benefits of emitting pollution for the only two chemical companies in an industry, Alpha Chemicals and Beta Chemicals. Before any tax on pollution emissions is imposed, each company views pollution as being free.Refer to Figure 16.5. The government decides to impose a tax on pollution emissions to cut total emissions in this industry in half, and based on this decision it has set the tax at $100 per ton of emissions. Following the implementation of this tax, the total amount of tax revenue collected by the government from this

?Figure 16.5Figure 16.5 shows the marginal benefits of emitting pollution for the only two chemical companies in an industry, Alpha Chemicals and Beta Chemicals. Before any tax on pollution emissions is imposed, each company views pollution as being free.Refer to Figure 16.5. The government decides to impose a tax on pollution emissions to cut total emissions in this industry in half, and based on this decision it has set the tax at $100 per ton of emissions. Following the implementation of this tax, the total amount of tax revenue collected by the government from this

tax will be

A. $5,000.

B. $7,500.

C. $10,000.

D. $20,000.

Answer: C

You might also like to view...

If a change passes the cost-benefit test, then

A) it is a Pareto improvement. B) it may be a Pareto improvement. C) it is not a Pareto improvement. D) total surplus is maximized.

Which concept did Hugo Grotius address and construct in his published work of the 1600s, The Law of War and Peace?

a. international regime b. just war theory c. preemptive attack d. prisoner's dilemma

Suppose that monetary neutrality holds. Of the following variables, which ones do not change when the money supply increases?

a. real interest rates b. inflation c. the price level d. real output e. real wages f. nominal wages

A company such as Microsoft or Pepsi Co. is a legal hassle to organize, difficult to monitor, and possibly could double tax income. It is an example of a:

A. sole proprietorship. B. corporation. C. partnership. D. consumer.