Suppose a risk-neutral power plant needs 10,000 tons of coal for its operations next month. It is uncertain about the future price of coal. Today it sells for $60 a ton but next month it could be $50 or $70 (with equal probability). How much would the power plant be willing to pay today for an option to buy a ton of coal next month at today's price? (Ignore discounting over the short period of a

month.)

a. 5

b. 4

c. 3

d. 0

a

You might also like to view...

Attempts to influence the law for your own private economic advantage is called

A) tax imposition. B) subsidizing. C) rent seeking. D) creating a deadweight loss.

According to classical economists, in recessions, not only does the unemployment rate increase, so does the

A) interest rate. B) level of fiscal stimulus. C) natural rate of unemployment. D) level of potential output.

If price is above the equilibrium price, then there will be:

A. excess demand. B. both excess supply and excess demand. C. excess supply. D. neither excess supply nor excess demand.

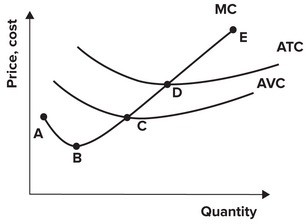

Refer to the graph shown. A perfectly competitive firm would never operate if the price dropped to which segment of the marginal cost curve?

A. DE. B. CD. C. AC. D. CE.