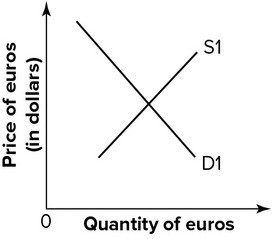

Refer to the graph shown. An increase in American interest rates would shift:

A. D1 left and S1 left, causing an appreciation of the euro.

B. D1 left and S1 right, causing a depreciation of the euro.

C. D1 right and S1 left, causing an appreciation of the euro.

D. D1 right and S1 right, causing a depreciation of the euro.

Answer: B

You might also like to view...

Aggregate private spending is stable according to non-activists PRIMARILY because

A) consumer spending is insulated from changes in income according to the PIH and LCH theories. B) private residential and non-residential investment is volatile. C) government spending is volatile. D) the money supply is unstable.

Suppose we observe the following two simultaneous events in the market for beef. First, there is a decrease in the demand for beef due to changes in consumer tastes

And second, there is a reduction in supply due to cattle farmers selling their land to real estate developers. We know with certainty that these two simultaneous events will cause which of the following? A) no change in the equilibrium quantity and a reduction in the equilibrium price B) an increase in the equilibrium quantity and in the equilibrium price C) a decrease in the equilibrium quantity and an indeterminate change in the equilibrium price D) a decrease in the equilibrium quantity and an increase in the equilibrium price

A natural monopoly is

A. An industry that is dominated by a single firm. B. An unregulated monopoly. C. An industry in which one firm can achieve economies of scale over the entire range of market supply. D. A monopoly that always benefits society even when it is unregulated.

An investment should be undertaken

A. any time the present value of the expected income stream associated with the investment is positive. B. if the present value of the costs of the investment project exceed the present value of the expected returns from the investment project. C. if the present value of the expected income stream associated with the investment is less than the full cost of the investment project. D. if the present value of the expected income stream associated with the investment is greater than the full cost of the investment project.