Suppose tax laws were reformed to encourage saving by increasing the rate of return on savings. Which of the following would be true?

a. Both the income effect and the substitution effect would tend to increase the amount of money a household saved.

b. The income effect would tend to increase household savings while the substitution effect would tend to decrease household savings.

c. The income effect would tend to decrease household savings while the substitution effect would tend to increase household savings.

d. Both the income effect and the substitution effect would tend to decrease the amount of money a household saved.

c

You might also like to view...

Which of the following do development economists NOT recommend to nations seeking to increase their rates of economic growth?

A) protecting home producers from international competition B) letting creative destruction run its course C) promoting increased education D) promoting private property rights

One way for governments to try and minimize the effects of structural unemployment is to:

A. subsidize retraining programs. B. mandate employers cannot fire anyone. C. increase unemployment benefits. D. All of these are ways that would minimize the effects of structural unemployment.

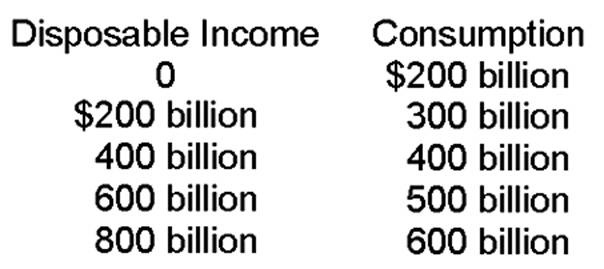

How much is the marginal propensity to save when disposable income rises from $400 billion to $600 billion?

A. .25

B. .5

C. .75

D. 1.0

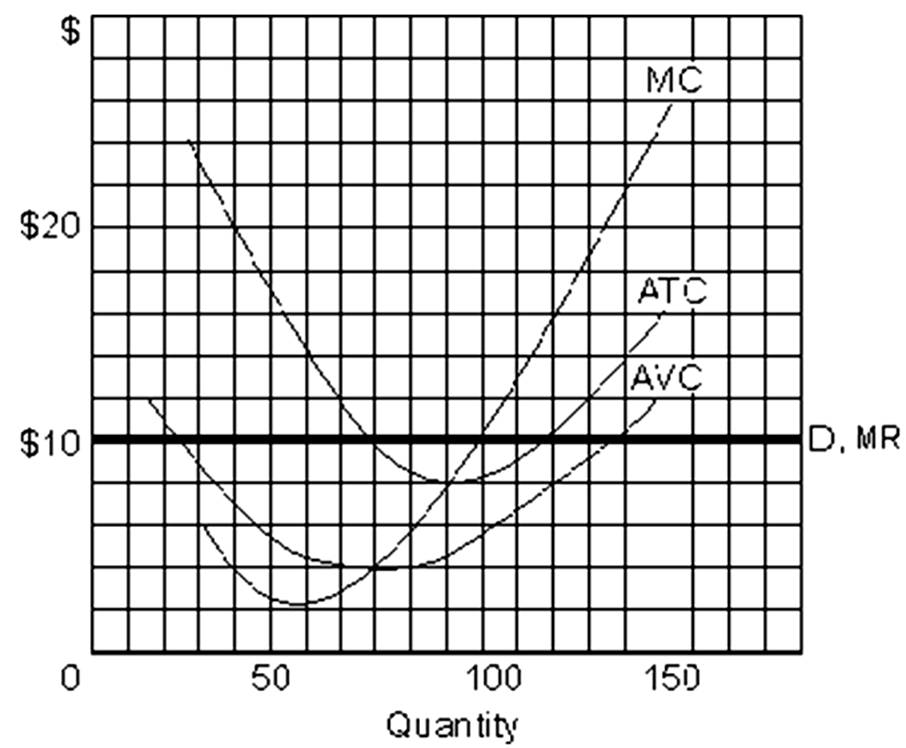

When operating at the profit-maximizing/loss-minimizing level of output, total revenue minus total cost is a little under

A. $200.

B. $100.

C. $45.

D. -$45.