Sometimes economists disagree because their scientific judgments differ. Which of the following instances best reflects this source of disagreement?

a. One economist believes everyone should pay the same percentage of their income in taxes; another economist believes that wealthier citizens should pay a higher percentage of their income in taxes.

b. One economist believes that manufacturing firms should face greater regulation to preserve the environment; another economist believes the government should not intervene in free markets.

c. One economist believes that equality should be valued over efficiency in policy decisions; another economist believes that efficiency should be valued over equality in policy decisions.

d. One economist believes the government should tax a household's income; another economist believes the government should tax a household's consumption.

d

You might also like to view...

Under a flexible exchange rate system, if the quantity supplied of dollars is greater than the quantity demanded of dollars, there is a:

A) balance of payments deficit and the dollar would depreciate. B) balance of payments surplus and the dollar would depreciate. C) balance of payments deficit and the dollar would appreciate. D) balance of payments surplus and the dollar would appreciate.

Total revenue is:

A. the amount that a firm spends on all inputs that go into producing a good or service. B. the quantity sold multiplied by the price paid for each unit. C. the quantity produced multiplied by the cost of producing each unit. D. the amount that an individual gets paid over a specified period of time, typically annually.

Which of the following characterizes the IACs?

a. High per capita GDP growth and high population growth. b. Low per capita GDP growth and low population growth. c. Low per capital GDP growth and high savings rate. d. Low human capital investment.

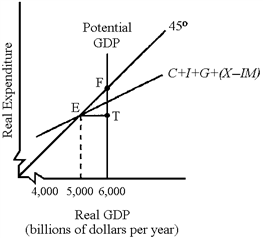

Figure 11-1

?

A. cut spending by 1,000. B. increase spending by 1,000. C. cut taxes by 1,000. D. increase spending by 250. E. cut taxes by 250.