Investors tend to trade on their beliefs rather than on pure facts. This statement might explain why securities markets have ________ that the efficient market hypothesis does not predict.

a. such a large trading volume

b. short sales

c. a random walk

d. arbitrage

Answer: a. such a large trading volume

You might also like to view...

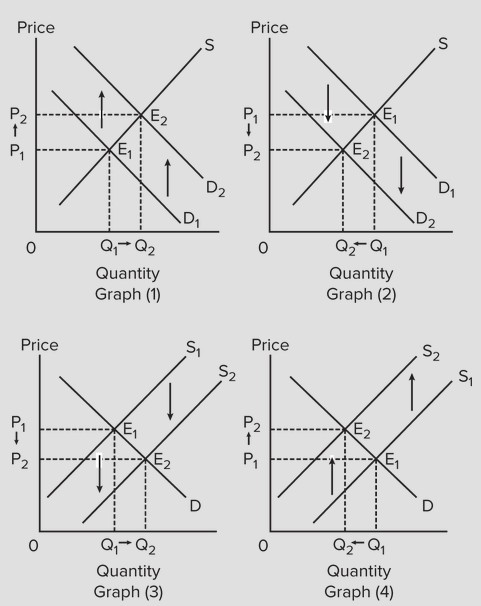

Assume that the graphs show a competitive market for the product stated in the question below. Select the graph above that best shows the change in the market following a tax placed on the suppliers in the market.

Select the graph above that best shows the change in the market following a tax placed on the suppliers in the market.

A. graph (1) B. graph (2) C. graph (3) D. graph (4)

The fraction of a change in disposable income that is spent on consumption is the

A) marginal propensity to consume. B) marginal dissaving ratio. C) expected future disposable income. D) marginal buying power of money. E) marginal propensity to dissave.

One result of adverse selection in the used car market is that few plums (high-quality) are sold.

Answer the following statement true (T) or false (F)

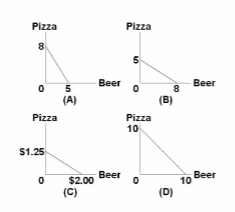

Refer to the graphs. Assume that pizza is measured in slices and beer in pints. In which of the graphs is the opportunity cost of a pint of beer equal to one slice of pizza?

A. Graph A.

B. Graph B.

C. Graph C.

D. Graph D.