In a system of flexible exchange rates, expansionary monetary policy abroad would induce

a. a rise in the U.S. exchange rate.

b. a fall in the U.S. rate of exchange.

c. a balance of payments surplus for the United States.

d. no change in U.S. exchange rates.

A

You might also like to view...

Regulation of the financial system

A) occurs only in the United States. B) protects the jobs of employees of financial institutions. C) protects the wealth of owners of financial institutions. D) ensures the stability of the financial system.

If a bank has total reserves of $40,000 and a 20 percent reserve requirement, then the maximum amount of demand deposits the bank can have if excess reserves are zero is

a. $100,000 b. $80,000 c. $300,000 d. $20,000 e. $200,000

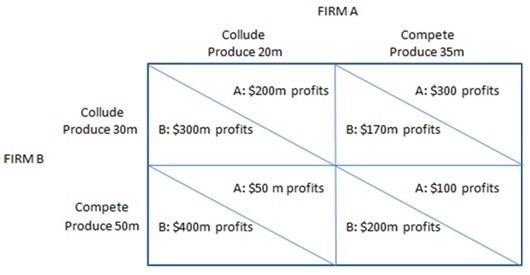

This prisoner's dilemma game shows the payoffs associated with two firms, A and B, in an oligopoly and their choices to either collude with one another or not. Given the payoffs in the matrix shown, Firm A:

Given the payoffs in the matrix shown, Firm A:

A. does not have a dominant strategy. B. has a dominant strategy to compete. C. has a dominant strategy to collude. D. None of these statements is true.

The demand for electricity is more elastic in the long run than in the short run because

A. consumers can shift to more efficient electrical appliances in the long run.

B. solar energy will eventually replace electricity in the long run.

C. government regulation of electricity producers is most effective in the long run.

D. more electricity can be produced in the long run.