Margaret Thatcher, the prime minister of Great Britain in the 1980s introduced a new system to replace local government taxes

The rates were replaced by the Community Charge or 'Poll Tax', which applied the same amount to every individual resident, with an 80% reduction for the unemployed. Inspite of the fact that this tax was unpopular and was eventually repealed can you think of any reason why it could be characterized as efficient? Can you think of any way that this tax could be evaded?

It could be regarded as efficient in that there really isn't much that people can do to avoid the tax. It is very much like a head tax. However, since it is levied based on voter registration rolls one way to evade the tax is simply to stop registering to vote.

You might also like to view...

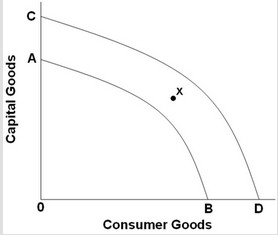

Use the following diagram to answer the next question. The most likely cause of a shift of a production possibilities frontier of an economy AB to CD is

The most likely cause of a shift of a production possibilities frontier of an economy AB to CD is

A. technological progress. B. allocative efficiency. C. a decrease in the price level. D. full employment of resources.

The intersection of the aggregate demand and aggregate supply curves determines the ________.

A. equilibrium level of real domestic output and prices B. per-unit cost of production in the economy C. shape of the aggregate demand curve D. productivity level in the economy

Fiat money is backed by gold

Indicate whether the statement is true or false

Suppose there is a high inequality in household income between the highest and the lowest income groups in one country. In response, the government raises the income tax for the highest income group and provides subsidies to the lowest-income group. What

would happen to the Lorenz curve as a result of the government programs? Explain. What will be an ideal response?