Explain the pros and cons of a crawling peg

What will be an ideal response?

A crawling peg involves fixing the exchange rate to a major world currency. This involves regular devaluations of a fixed amount in order to stabilize the real exchange rate in a country with higher inflation than its trading partners. Maintaining the peg requires the monetary authority to exercise discipline in the creation of new money and is anti-inflationary in that sense. Countries frequently try to reinforce the anti-inflation tendency of the crawling peg by intentionally devaluing at a slower pace than the difference between home and foreign inflation. This creates real appreciation in the exchange rate, and is intended to act as a brake on domestic inflation as foreign goods become cheaper in real terms. The use of the exchange rate in this manner has mixed success in helping control inflation, but in a number of cases it has led to severe overvaluation of the real exchange rate and increased the country's vulnerability to a crisis.

Another way in which a crawling peg exchange rate system increases a country's vulnerability to crisis is that it is sometimes politically difficult to exit from the system if it becomes overvalued. When a government announces a change in the system, it runs the risk of losing its credibility. A sudden large devaluation leads to economic losses and a loss of confidence in the country's policy makers, and thus it is common for countries to delay addressing the problem of overvaluation, so that when the correction comes, it has to be larger.

You might also like to view...

Suppose that the basket of goods purchased by the typical consumer costs $188.80 this year and it cost $160 in the base year. The CPI in the base year would be

A) 85.11. B) 100.0. C) 118.0. D) 348.8.

Considering all costs of production, the marginal cost of producing a hot dog is $1.00. The price of a hot dog is $1.50. Thus, the producer surplus from this hot dog is

A) $1.50. B) $1.00. C) $.50. D) Zero, because $1.50 is the most anyone would pay for a hot dog.

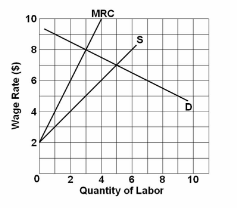

Refer to the labor market diagram where D is the labor demand curve, S is the labor supply curve, and MRC is the marginal resource (labor) cost curve. An inclusive union could increase the level of employment above that which the monopsonist would provide if it could get the monopsonist to agree to any wage rate:

A. below $7.

B. between $5 and $8.

C. above $5.

D. above $8.

One of the peculiarities of the U.S. market for health care is:

A. Third-party payments by insurance companies B. Government-provided health insurance C. Government tax credits and vouchers for consumers to pay for health care D. Fee-for-service payments for all physician visits