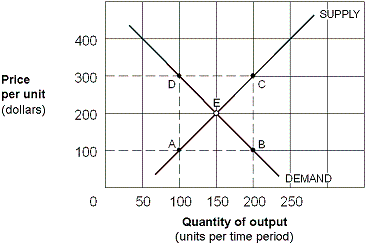

Exhibit 5-9 Supply and Demand Curves for Good X

?

In Exhibit 5-9, assume the government places a $200 per unit sales tax on Good X. The percentage of the burden of taxation paid by consumers of Good X is:

A. zero.

B. 25 percent.

C. 50 percent.

D. 100 percent.

Answer: C

You might also like to view...

An aggregate production function shows the relationship between

A) real GDP and leisure. B) real GDP and the quantity of labor employed. C) leisure and unemployment. D) real GDP and unemployment.

If the long-run supply curve slopes upward, we know that this is

A) a decreasing-cost industry. B) a constant-cost industry. C) an increasing-cost industry. D) a situation in which no input prices change as firms enter and exit the industry.

If the average propensity to consume is initially 0.85, the marginal propensity to consume is 0.75, and real disposable income increases by $1000, the value of saving

A. increases by $250. B. decreases by $250. C. increases by $150. D. decreases by $150.

A monopolist will ________ if marginal revenue is negative.

A. increase production B. not produce C. maintain its current production level D. shut down