Suppose the price of one euro is fixed at $1.00. A Dutch oil company discovers new oil reserves in the North Sea and offers the oil for sale. What is the impact on the foreign exchange market?

a. The dollar price of euros decreases from $1.50 to $1.00.

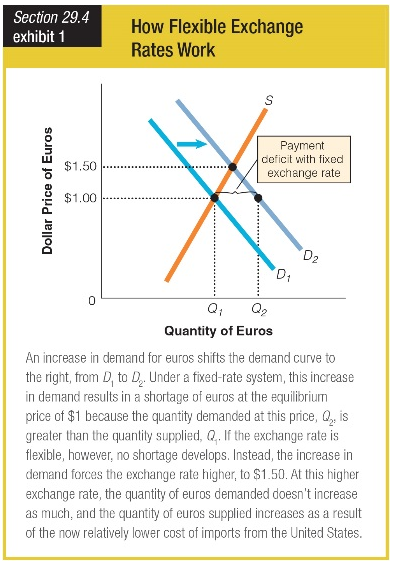

b. Decreasing demand for European goods shifts D2 to D1.

c. U.S. consumers demand more European goods shifting D1 to D2.

d. The quantity of euros demanded changes from Q2 to Q1.

c. U.S. consumers demand more European goods shifting D1 to D2.

You might also like to view...

With respect to real per capita incomes, the United States' position

a. as leader has reversed with the United Kingdom since 1980. b. as leader has reversed with Canada since 1980. c. as leader has reversed with Sweden since 1980. d. has not changed much since 1980.

A lower discount rate discourages banks from borrowing reserves and making loans. Therefore, if the Fed wants to expand the money supply, it raises the discount rate

a. True b. False Indicate whether the statement is true or false

In contrast to the need for legal enforcement under a system of direct controls, a taxes approach

a. is subject to greater uncertainty of payment of fees. b. makes taxes automatic and certain. c. speeds the prosecution and conviction process. d. does not actually reduce pollution, merely the cost of monitoring it.

Suppose that a town has two major bottling plants. One of these bottling plants is unionized and the union has just negotiated a 7% wage increase each year for the next two years. Which of the following is most likely to occur?

A. The only effect will be that the price charged by the unionized bottling plant will increase to cover the additional costs of labor. B. The price of labor will change in both the unionized and nonunionized bottling plants, but no other input markets will be affected. C. The price of labor will change in both the unionized and nonunionized bottling plants. Employment of labor and other inputs is also likely to change in both bottling plants. D. The price of labor in the unionized bottling plant will increase, but there will be no changes in the price of labor in the nonunionized bottling plant.