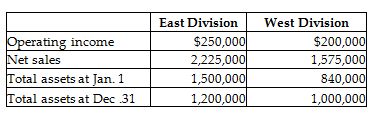

The following is divisional information for Kingfisher Enterprises:

The target rate of return is 12% for the East Division and is 10% for the West Division.

Compute residual income for each division.

Average assets: (Beginning assets + Ending assets) / 2

East Division = ($1,500,000 + $1,200,000) / 2

= $2,700,000 / 2

= $1,350,000

West Division = ($840,000 + $1,000,000) / 2

= $1,840,000 / 2

= $920,000

Minimum acceptable operating income = Average assets × Target rate of return

East Division = $1,350,000 × 0.12

= $162,000

West Division = $920,000 × 0.10

= $92,000

Residual income = Operating income — Minimum acceptable operating income

East Division = $250,000 - $162,000 = $88,000

West Division = $200,000 - $92,000 = $108,000

You might also like to view...

An attempt to deceive others for personal gain is known as:

A. incentive. B. fraud. C. larceny. D. opportunity.

The accounting equation can be restated as: Assets ? Equity = Liabilities.

Answer the following statement true (T) or false (F)

Research conducted by Aperian Global identified five abilities returning expatriates thought necessary for a successful global leadership assignment, including

A. localizing. B. innovating. C. negotiating. D. monitoring. E. advocating for the company.

Customers may be served:

A) according to a number assigned to each item. B) on a first-come-first-serve basis. C) on a last-come-first-serve basis. D) all of the above