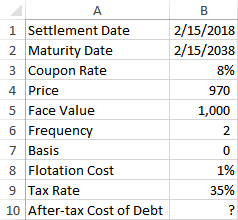

What is the correct formula in B9 to calculate the after-tax cost of debt?

a) =YIELD(B1,B2,B3,B4*(1-B8)/B5*100,B5/B5*100,B6,B7)*(1-B9)

b) =YIELD(B1,B2,B3,B4*(1-B8)/B5*100,B5/B5*100,B6,B7)

c) =YIELD(B1,B2,B3,B4*(1-B9)/B5*100,B5/B5*100,B6,B7)*(1-B8)

d) None of the above

a) =YIELD(B1,B2,B3,B4*(1-B8)/B5*100,B5/B5*100,B6,B7)*(1-B9)

You might also like to view...

Which of the following represents the correct sequence of steps in the problem-solving process?

a. Recognize and define the problem; select a method of solution; collect and organize the data; arrive at an answer b. Select a method of solution; recognize and define the problem; collect and organize the data; arrive at an answer c. Recognize and define the problem; collect and organize the data; select a method of solution; arrive at an answer d. Select a method of solution; collect and organize the data; recognize and define the problem; arrive at an answer

Cheapo Sales Company uses a standard cost system

Overhead costs are allocated based on direct labor hours. In the first quarter, Cheapo Sales had a favorable efficiency variance for variable overhead costs. Which of the following scenarios is a reasonable explanation for this variance? A) The actual number of direct labor hours was lower than the budgeted hours. B) The actual variable overhead costs were higher than the budgeted costs. C) The actual variable overhead costs were lower than the budgeted costs. D) The actual number of direct labor hours was higher than the budgeted hours.

Craig Ripley sold his stock in Gandy Corporation for a price less than what he paid for it. Craig will experience

A) a capital loss tax. B) a capital gains tax. C) a capital gain. D) a capital loss. E) bracket creep.

Mullins Corporation uses the FIFO method in its process costing system. Data concerning the first processing department for the most recent month are listed below: Beginning work in process inventory: Units in beginning work in process inventory 700 Materials costs$11,500 Conversion costs$22,200 Percent complete with respect to materials 75%Percent complete with respect to conversion 65%Units started into production during the month 8,600 Units transferred to the next department during the month 7,800 Materials costs added during the month$159,300 Conversion costs added during the month$348,500 Ending work in process inventory: Units in ending work in process inventory 1,500 Percent complete with respect to materials 65%Percent complete with respect to

conversion 50% What are the equivalent units for conversion costs for the month in the first processing department? A. 750 B. 9,300 C. 8,095 D. 7,100