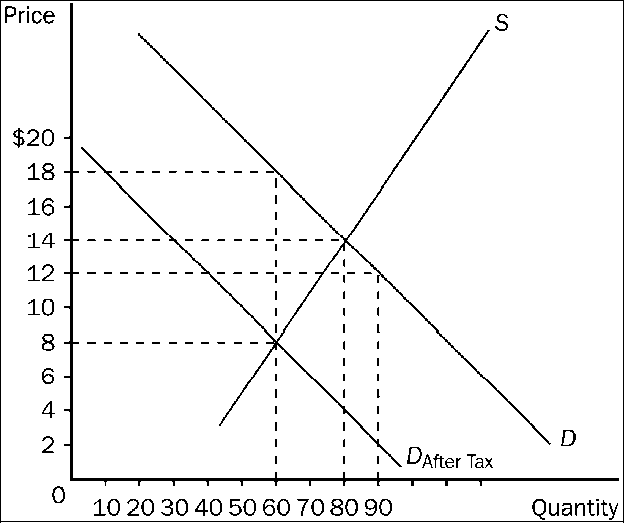

Figure 4-21

Refer to . The price paid by buyers after the tax is imposed is

a.

$18.

b.

$14.

c.

$12.

d.

$8.

a

You might also like to view...

What happens when the government imposes a unit excise tax on a good?

A) The amount of the tax is added to the current equilibrium price. B) The demand for the newly taxed good decreases. C) That good's supply curve shifts down by the amount of the tax. D) The newly taxed good's supply curve shifts vertically upward by the amount of the per-unit tax being levied.

Regulation of enterprises by the government has always been found to make the market more efficient

a. True b. False Indicate whether the statement is true or false

The labor supply curve represents: a. the relationship between the wage rate and labor productivity

b. the tradeoff between labor and leisure. c. the relationship between the wage rate and the quantity supplied of labor. d. the tradeoff between labor and capital as alternative factors of production.

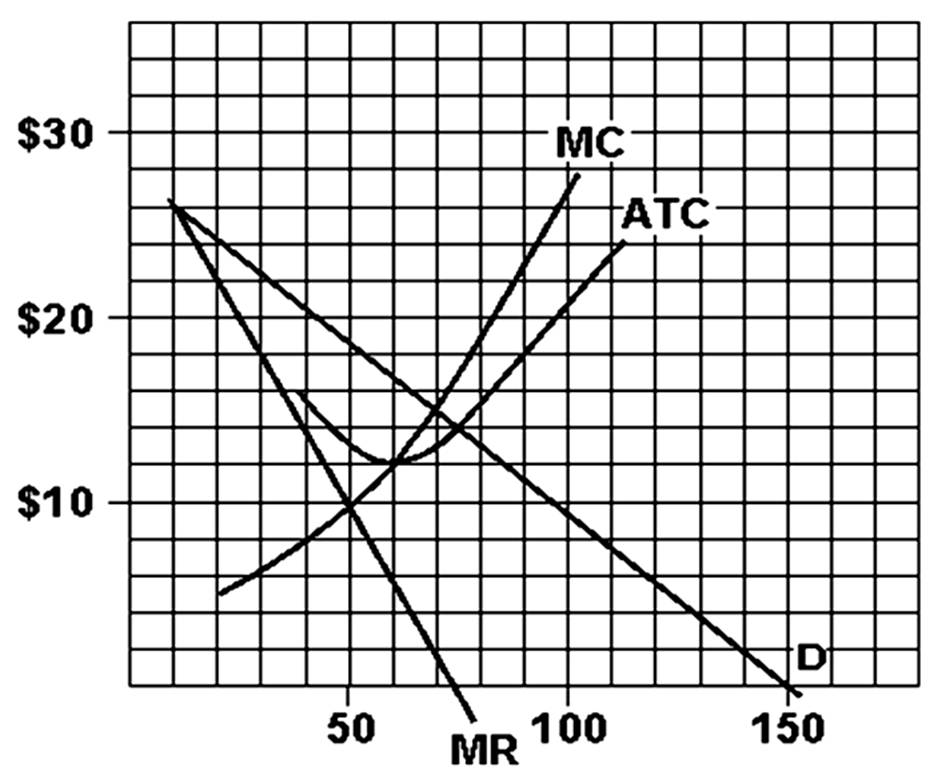

If this firm were a perfect competitor, at what output would it produce in the long run?

A. 50 units

B. 60 units

C. 70 units

D. 75 units