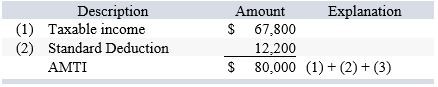

Jerusha is married and she files a separate tax return in 2019. She claimed the standard deduction for regular tax purposes ($12,200). She had no other adjustments. Her regular taxable income was $67,800. What is Jerusha's AMTI?

What will be an ideal response?

$80,000

Answer computed as follows:

You might also like to view...

What cost concept used in applying the cost-plus approach to product pricing covers selling expenses, administrative expenses, and desired profit in the "markup"?

A) Total cost concept B) Product cost concept C) Variable cost concept D) Sunk cost concept

LONG or LONG RAW variables can be declared in triggers and the NEW and OLD qualifiers cannot refer to these types of columns.

Answer the following statement true (T) or false (F)

What makes up the core of the servant leadership process?

A. antecedent conditions B. characteristics of the leader C. servant leader behaviors D. context and culture

E-commerce can be defined as:

A) the use of the Internet, the Web, and mobile apps to transact business. B) the use of any Internet technologies in a firm's daily activities. C) the digital enablement of transactions and processes within an organization. D) any digitally enabled transactions among individuals and organizations.