Consider a coupon bond that pays $100 every year and repays its principal amount of $1,000 at the end of 10 years. If the annual rate of discount is 10 percent, the present value of the bond is approximately

A. $909.09.

B. $990.00.

C. $1,000.00.

D. $1,100.00.

Answer: C

You might also like to view...

In Unified Modeling Language (UML) Class diagrams, Associations are represented by dashed lines.

Answer the following statement true (T) or false (F)

Which of these changes would have no effect on which supplier is chosen in the output range of 0 units to 20,000 units?

A) Variable costs fall 10% for all bidders. B) Fixed costs rise 10% for all bidders. C) Companies A and B swap their figures for fixed costs. D) Companies C and D swap their figures for fixed costs.

All of the following are types of user documentation EXCEPT:

A) release description. B) reference guide. C) acceptance sign-off. D) entity-relationship diagrams. E) user's guide.

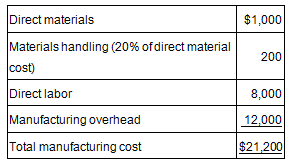

Zelean Manufacturing uses 10 units of part KJ37 each month in the production of radar equipment. The cost to manufacture one unit of KJ37 is presented in the accompanying table.

Materials handling represents the direct variable costs of the receiving department and is applied to direct materials and purchased components on the basis of their cost. This is a separate charge in addition to manufacturing overhead. Zelean's annual manufacturing overhead budget is one-third variable and two-third fixed. Scott Supply, one of Zelean's reliable vendors, has offered to supply part KJ37 at a unit price of $15,000. The fixed cost of producing KJ37 is the cost of a special piece of testing equipment that ensures the quality of each part manufactured. This testing equipment is under a long-term, noncancelable lease. If Zelean were to purchase part KJ37, materials handling costs would not be incurred.

Required:

a. If Zelean purchases the KJ37 units from Scott, the capacity Zelean was using to manufacture these parts would be idle. Should Zelean purchase the parts from Scott? Make explicit any key assumptions.

b. Assume Zelean Manufacturing is able to rent all idle capacity for $25,000 per month. Should Zelean purchase from Scott Supply? Make explicit any key assumptions.

c. Assume that Zelean Manufacturing does not wish to commit to a rental agreement but could use idle capacity to manufacture another product that would contribute $52,000 per month. Should Zelean manufacture KJ37? Make explicit any key assumptions.