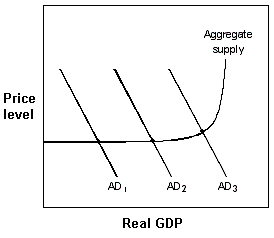

Exhibit 20-4 Aggregate demand and supply model

?

In Exhibit 20-4, which one of the following actions could the Fed use to shift the AD curve from AD1 to AD2?

A. raise the legal reserve requirement

B. raise the discount rate

C. increase the federal funds rate

D. buy government securities

Answer: D

You might also like to view...

A key finding of the economic analysis of financial structure is that

A) the existence of the free-rider problem for traded securities helps to explain why banks play a predominant role in financing the activities of businesses. B) while free-rider problems limit the extent to which securities markets finance some business activities, nevertheless the majority of funds going to businesses are channeled through securities markets. C) given the great extent to which securities markets are regulated, free-rider problems are not of significant economic consequence in these markets. D) economists do not have a very good explanation for why securities markets are so heavily regulated.

If the Fed sells government bonds on the open market, which of the following is likely to occur?

A. The money supply will expand. B. The market rate of interest on government bonds will increase. C. The market rate of interest on corporate bonds will decrease. D. The amount of investment spending will increase.

Money is:

a. valuable because it is backed by gold. b. any items used in barter. c. an illiquid asset. d. none of these.

Which of the following statements about nominal interest and real interest is true?

A. Nominal interest is a yearly rate and real interest is a monthly rate. B. Nominal interest does not adjust for inflation, whereas real interest does. C. Nominal interest is what the lender receives and real interest is what the borrower pays. D. Nominal interest and real interest are two ways of saying the same thing.