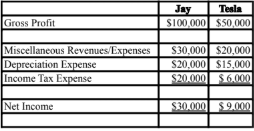

The amount of gross profit appearing on Jay's 2019 Consolidated Income Statement would be:

Jay Inc. owns 80% of Tesla Inc. and uses the cost method to account for its investment. The 2019 income statements of both companies are shown below.

On January 1, 2019, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%.

A) $147,000. B) $153,000. C) $147,600. D) $150,000.

D) $150,000.

You might also like to view...

The time and cost barriers associated with distance have increased over the past decade

Indicate whether the statement is true or false

When does communication actually happen in the four-step strategic planning process of public relations?

A. Research step D. Evaluation step B. Planning step E. None of the above C. Implementation step

The Kodak employee had an arrangement with:

a. An appraiser. b. An assessor. c. Both a and b d. None of the above

If spending exceeds the amount of your income over a period of time, your best option is probably to

A) reduce your spending. B) sell some of your assets. C) increase your work hours. D) get a second job.