Marty is a 40 percent owner of MB Partnership. Marty has decided to sell his interest in the business to Emilio for $100,000 cash plus the assumption of his share of MB's liabilities. Assume Marty's inside and outside basis in MB are equal. MB shows the following balance sheet as of the sale date:Assets:Basis FMVCash$160,000 $160,000Receivables50,000 50,000Inventory80,000 170,000Land held for investment60,000 40,000Totals$350,000 $420,000 Liabilities and capital:Liabilities$120,000Capital-Marty92,000 -Barry138,000Totals$350,000 What is the amount and character of Marty's recognized gain or loss?

What will be an ideal response?

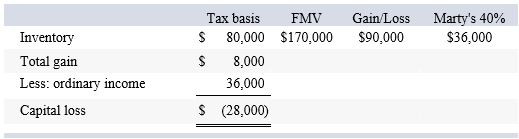

$28,000 capital loss and $36,000 ordinary income.

| Amount realized: | |||||

| Cash | $100,000 | ||||

| Debt relief | 48,000 | $ | 148,000 | ||

| Less: basis in partnership interest (including liabilities) | (140,000 | ) | |||

| Marty's realized and recognized gain | $ | 8,000 | |||

To the extent Marty realizes any amounts attributable to hot assets, his gain will be classified as ordinary. If MB sold its assets for their fair market value at the sale date, the ordinary gain would be as follows:

You might also like to view...

________ technology involves using hardware and software delivered over a network, such as the Internet, allowing users access to data without having to pay for additional equipment or infrastructure.

A. Online information fulfillment B. Cloud computing C. Internet call-back D. Voice over Internet Protocol

A news release that has news value must ________

A) be newsworthy in the context of the organization B) be subjective according to the source C) omit all source attribution D) include hyperbole and jargon

Fill in all of the missing information from the table

Carrie meticulously calculated the early and late start and finish times for her latest project and recorded them using different colors of sand on a pristine slab of white marble. She used red for late start and late finish times and green for early start and early finish times. Activity durations and their identifiers were written with black sand. She finished her task and had an opportunity to admire her work only briefly before a colleague came by and swept most of it away. Sadly, this was before Carrie could record the numbers on a more permanent medium, so now she turns to you to help. Activity Predecessor Duration Early Start Early Finish Late Start Late Finish A - 10 B - 7 11 C A 7 D A 15 14 E B 11 19 F B 10 G D,E 24 H F 24 J C 28 K G,H,J 36

Under the UPA, after dissolution:

a. the partnership must be liquidated. b. the remaining partners have the right to continue the partnership if the majority of them agree. c. the remaining partners have the right to continue the partnership if the partnership was dissolved in contravention of the partnership agreement. d. the partnership must be liquidated only if the dissolution was caused by the expulsion of a partner in accordance with the partnership agreement.