Jerry's Quarry sells building stone in a perfectly competitive market. At its current level of building stone production, Jerry's Quarry has marginal costs equal to $45, and AVC is rising. If the market price of building stone is $50, Jerry's Quarry should:

A. decrease its level of building stone production.

B. continue producing its current level of production.

C. increase its production of building stone.

D. shut down and produce no building stone.

Answer: C

You might also like to view...

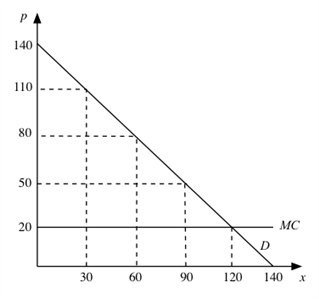

Suppose the market demand curve is as depicted in the graph, and all firms have constant

1

1

24

////AA==

marginal costs of 20. Assume that consumer tastes in x are quasilinear.

b. Suppose the government imposes a price ceiling of 40 on the monopolist from part (a). How does this change the value of consumer surplus and monopoly profit? c. Suppose instead that this market has two Cournot competitors. Illustrate their best-response functions (labeling intercepts and slopes) as well as the Nash equilibrium. What is the value of consumer surplus and profit in the market now? d. If the same price ceiling of 40 is imposed on the Cournot oligopoly, how will the best response functions change? (Assume that, if there is a good that is produced but does not get bought, it is equally likely that firm 1 gets stuck with the good as it is that firm 2 gets stuck with it, and it costs at least a penny to dispose of a good you are stuck with.) Is there more than one possible Nash equilibrium? e. Will overall surplus increase? f. Does your answer to (e) change if the price ceiling is imposed on Bertrand price competitors?g. True or False: Whenever price ceilings impact the price at which goods are traded, they disturb the price signal and therefore result in deadweight losses. What will be an ideal response?

The Laffer curve shows the relationship between tax:

a. revenue and tax rates. b. revenue and take-home pay. c. revenue and government spending. d. rates and take-home pay. e. rates and government spending.

A person with AIDS has a guaranteed right to apply for health insurance and receive coverage at the same rate as a healthy person. What is the likely result for the insurance company?

a. Rational ignorance b. The principle-agent problem c. The substitution effect d. Externalities e. Adverse selection

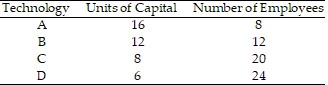

Use the information provided in Table 7.2 below to answer the question(s) that follow.

Table 7.2Inputs Required to Produce a Product Using Alternative Technologies Refer to Table 7.2. If the hourly wage rate is $10 and the hourly price of capital is $50, which production technology should be selected?

Refer to Table 7.2. If the hourly wage rate is $10 and the hourly price of capital is $50, which production technology should be selected?

A. A B. B C. C D. D