Each person is better off with a bigger tax return than with a small tax return. That means that everyone would be better off if all taxes were zero. A person saying that is

A. wrong because firms operate on jealousy.

B. wrong because causation and correlation are not the same.

C. wrong and have fallen victim to the fallacy of composition.

D. right.

Answer: C

You might also like to view...

Suppose leisure is on the horizontal axis and dollars are on the vertical axis in the consumer-choice diagram. What happens to the budget line when a head tax is imposed?

a. The budget line shifts inward, but it may become steeper or flatter depending on the size of the head tax.

b. The budget line pivots about the horizontal intercept, becoming steeper.

c. The budget line become flatter, with the vertical intercept falling and the horizontal intercept remaining fixed.

d. There is an inward, parallel shift in the budget line.

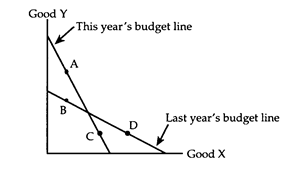

Refer to Figure 18-1. Currency speculators believe that the value of the euro will decrease relative to the dollar. Assuming all else remains constant, how would this be represented?

A) Supply would increase, demand would decrease and the economy moves from C to B to A. B) Supply would decrease, demand would decrease and the economy moves from B to C to D. C) Supply would increase, demand would increase and the economy moves from D to A to B. D) Supply would decrease, demand would increase and the economy moves from A to D to C.

Refer to Table 16-3. If Julie charges $10 per hour, what is the value of the consumer surplus received by Dawn?

A) $2 B) $10 C) $12 D) $22

Investments that are mistakenly made and generate losses

a. will occur when future revenues are known with certainty. b. indicate that the capital market is incapable of generating wealth. c. are normal costs of developing new projects and technologies in a world of uncertainty. d. will not occur when capital markets are operating efficiently.