Kneeland Corporation has two divisions: Grocery Division and Convenience Division. The following report is for the most recent operating period: Total CompanyGrocery DivisionConvenience DivisionSales$427,000$321,000$106,000Variable expenses 119,380 70,620 48,760Contribution margin 307,620 250,380 57,240Traceable fixed expenses 239,000 194,000 45,000Segment margin 68,620 56,380 12,240Common fixed expense 46,970 35,310 11,660Net operating income$21,650$21,070$580 The common fixed expenses have been allocated to the divisions on the basis of sales. Required:a. What is the Grocery Division's break-even in sales dollars?b. What is the Convenience Division's break-even in sales dollars?c. What is the company's overall break-even in sales dollars?d. What would be the

company's overall net operating income if the company operated at its two division's break-even points?

What will be an ideal response?

a.

Grocery Division break-even:

Segment CM ratio = Segment contribution margin ÷ Segment sales

= $250,380 ÷ $321,000 = 0.780

Dollar sales for a segment to break even = Traceable fixed expenses ÷ Segment CM ratio

= $194,000 ÷ 0.780 = $248,718

b.

Convenience Division break-even:

Segment CM ratio = Segment contribution margin ÷ Segment sales

= $57,240 ÷ $106,000 = 0.540

Dollar sales for a segment to break even = Traceable fixed expenses ÷ Segment CM ratio

= $45,000 ÷ 0.540 = $83,333

c.

The company's overall break-even sales:

CM ratio = Contribution margin ÷ Sales

= $307,620 ÷ $427,000 = 0.720 (rounded)

Total fixed expenses = Total traceable fixed expenses + Common fixed expenses

= $239,000 + $46,970 = $285,970

Dollar sales to break even = Total fixed expenses ÷ CM ratio

= $285,970 ÷ 0.720 = $396,948 (using the unrounded CM ratio)

d. If the company operates at the break-even points for its two divisions, it will have a net operating loss of $46,970 because it will not cover its common fixed expense of $46,970.

You might also like to view...

Which of the following accounts is not considered a selling expense?

a. Sales Salaries; b. Insurance Expense; c. Advertising Expense; d. Delivery Expense; e. Bank Credit Card Expense

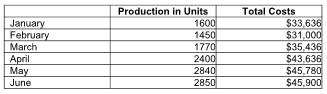

Using the high-low method, the total fixed costs are ________. (Round intermediate calculations to two decimal places, and the final calculation to the nearest dollar.)

Bernard Company shows the following manufacturing costs for the first six months of the year:

Use the value stream map to conduct a complete analysis of the carpincho wallet production process. Calculate all raw material and WIP lead times and determine overall process capacity assuming El Gran Raton uses a batch size of 300 units

If a single carpincho wallet were ordered today, how long before it would reach the back pocket of the delighted customer if his order is but one of an average of 2230 orders (all for a single wallet) during an average 5 day work week. *Assume that the days indicated on the lead time ladder are based on a different batch size and not applicable to the 300 unit batch currently in use.*

Both dynamic programming and linear programming take a multi-stage approach to solving problems

Indicate whether the statement is true or false