A $40 billion reduction in taxes increases Real GDP by $150 million. Assuming a constant price level, what does the tax multiplier equal?

A) 3.75

B) 3.00

C) 37.50

D) 0.27

E) ?0.73

A

You might also like to view...

An important reason why Ricardian equivalence may fail is if

A) borrowing and lending are done through intermediaries. B) government debt incurred today may not be paid off until after some current consumers are deceased. C) state and local governments also engage in debt finance. D) some consumers are borrowers, while other consumers are lenders.

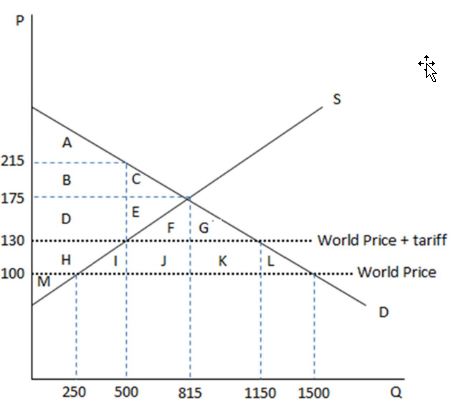

According to the graph shown, the amount of surplus enjoyed by domestic consumers with free trade before the tariff is area:

This graph demonstrates the domestic demand and supply for a good, as well as a tariff and the world price for that good.

A. A

B. ABC

C. ABCDEFG

D. ABCDEFGHIJKL

In the United States, the overall level of prices more than doubled during the

a. 1950s. b. 1960s. c. 1970s. d. 1980s.

Which of the following represents an action by the Federal Reserve that is designed to decrease the money supply?

A. an increase in the required reserve ratio B. an increase in federal spending C. a decrease in the discount rate D. buying government securities in the open market