Consider the following data below which describe the relationship between income and a tax. The tax may be best described as:

A. Regressive at lower income levels and progressive at higher income levels

B. Regressive at lower income levels and proportional at higher income levels

C. Proportional at lower income levels and regressive at higher income levels

D. Proportional at lower income levels and progressive at higher income levels

C. Proportional at lower income levels and regressive at higher income levels

You might also like to view...

Why might an individual set up trusts?

A. as a strategy to avoid taxes on wealth. B. for lower insurance premiums. C. to insure the security of a loan. D. to have a steady stream of income during retirement.

An increase in price will lead to an increase in quantity supplied. This statement is

A) the law of supply. B) the law of demand. C) untrue always. D) a normative statement.

Which of the following statements is correct?

a. A minimum wage law will result in less additional unemployment if labor demand is elastic rather than inelastic. b. An in-kind transfer allows a person to use the benefit to purchase whatever they think they need most. c. If a tax policy states that taxes owed equal 1/3 of income less $15,000 . a person earning $25,000 per year would owe $6,666.67 in taxes. d. Welfare reform enacted in 1996 limited the amount of time recipients could stay on welfare.

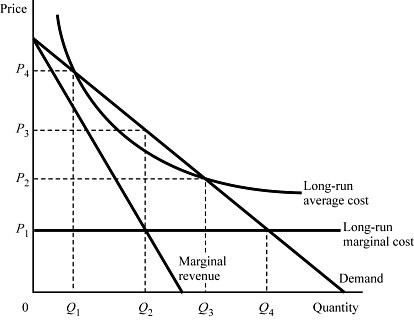

With average-cost pricing, the firm in Figure 8.14 would be:

With average-cost pricing, the firm in Figure 8.14 would be:

A. making a zero economic profit. B. losing money. C. making a positive economic profit. D. shut down.