A tax that is imposed as a specific amount per unit of a good is a(n)

A) excise or specific tax.

B) sales or ad valorem tax.

C) compound duty.

D) income tax.

A

You might also like to view...

Despite the warning on a package of cigarettes about the potential health hazards of smoking, a man lights up a cigarette. An economist would conclude that: a. in the man's judgment, the expected marginal cost of smoking the cigarette outweighs the expected marginal benefit. b. the man is behaving irrationally

c. the smoker is unconcerned about his future health. d. in the man's judgment, the expected marginal benefit of smoking the cigarette outweighs the expected marginal cost.

When the wage rate rises, the substitution effect leads a worker to

a. increase consumption while the income effect leads to a decrease in consumption. b. decrease consumption while the income effect leads to an increase in consumption. c. increase consumption, as does the income effect. d. substitute sleep for other leisure.

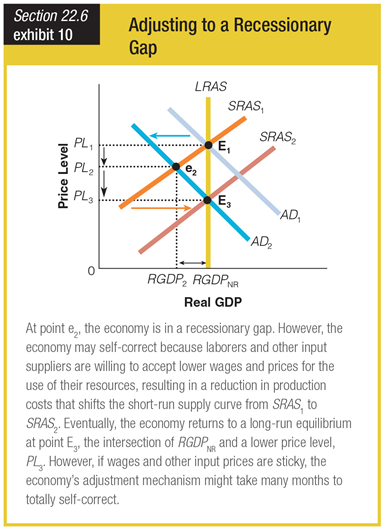

Assume an economy moves from E1 to e2 to E3. Which of the following statements accurately describes the situation shown?

a. The economy recovers from the recessionary gap by moving from E1 to e2.

b. The economy begins and ends in both short-run and long-run equilibrium.

c. The economy recovers from the recessionary gap by moving from E3 to e2.

d. The economy begins in long-run equilibrium but ends in a recessionary gap.

Suppose that surplus labor in a Pakistani village is used to build a medical clinic and dig several wells. This is an illustration of:

A. foreign aid. B. capital-saving investment. C. in-kind investment. D. technological advance.