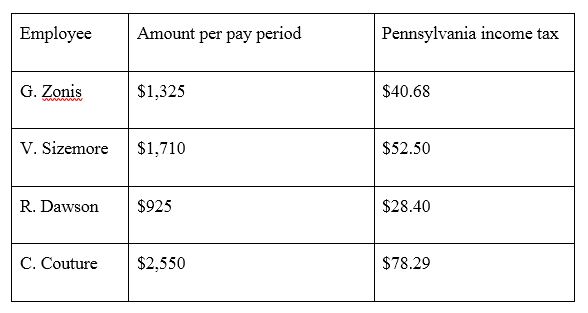

Christensen Ranch operates in Pennsylvania. Using the state income tax rate of 3.07%, calculate the state income tax for each employee.

What will be an ideal response?

You might also like to view...

Rafael is a citizen of Spain and a resident of the United States. During the current year, Rafael received the following income:Compensation of $5 million from competing in tennis matches in the U.S.Cash dividends of $10,000 from a Spanish corporation that earns 50 percent of its income from sales in the United StatesInterest of $2,000 from a Spanish citizen who is a resident of the U.S.Rent of $5,000 from U.S. residents who rented his villa in ItalyGain of $10,000 on the sale of stock in a German corporationDetermine the source (U.S. or foreign) of each item of income Rafael received.

What will be an ideal response?

Deepwater Dredging represents that it has corporate status to Estuary Marina when in fact Deepwater has not incorporated. The parties sign a contract that Deepwater does not perform. Estuary files a suit for breach. The court will likely hold that Deepwater is A) a corporation by estoppel

B) not a corporation and therefore not liable on the contract. C) a de facto corporation. D) a de jure corporation.

JT purchases 1,000 shares of stock at $14.78 per share in January 2006. He sells the 1,000 shares in

January 2010 for $15.50 per share. What is his internal rate of return? A) 11.2% B) 2.11% C) 1.2% D) 1.12%

Under the hazard communication standard, an employer must develop a written hazard communication program

a. True b. False Indicate whether the statement is true or false