What is the criticism leveled against deposit insurance by the FDIC?

Depositors who are freed from any risk of loss from a failing bank will not bother to shop around for safer banks. This problem is an example of what is called the moral hazard problem: the general idea that, when people are well-insured against a particular risk, they will put little effort into making sure that the risk does not occur. In this context, some of the FDIC's critics argue that high levels of deposit insurance actually make the banking system less safe.

You might also like to view...

According to the laws of demand and supply, if the price of beef increases, which of the following likely will occur?

A. The quantity demanded will decrease. B. The quantity demanded will remain constant. C. The quantity demanded will increase. D. The equilibrium price will increase but there will be no change in the market price. E. The quantity supplied will decrease.

The government of country A has decided to maintain an exchange rate of 1 unit of its currency for 6 U.S. dollars in the long run. Country A can be said to have a:

A) managed exchange rate system. B) fully flexible exchange rate system. C) nominal exchange rate system. D) fixed exchange rate system.

Which statement is true?

A. The federal government collects much more in direct taxes than in indirect taxes. B. The federal government collects much more in indirect taxes than in direct taxes. C. The federal government collects the same amount in direct taxes as in indirect taxes.

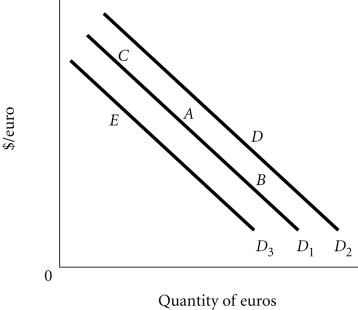

Refer to the information provided in Figure 34.2 below to answer the question(s) that follow. Figure 34.2Refer to Figure 34.2. The dollar is currently at Point A. A depreciation of the euro causes a movement to Point

Figure 34.2Refer to Figure 34.2. The dollar is currently at Point A. A depreciation of the euro causes a movement to Point

A. E. B. B. C. C. D. D.