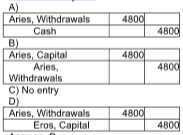

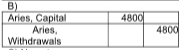

Aries and Eros start a partnership with capital contributions of $37,000 and $63,000, respectively. Over the course of the year, Aries withdraws $4800 from the business in order to meet his personal expenses. Which of the following is the correct journal entry to close the relevant Withdrawals account at the end of the year?

Business

You might also like to view...

Arbitrage opportunities represent a disadvantage of international expansion.

Answer the following statement true (T) or false (F)

Business

When the estimates involved in earnings management begin moving outside a reasonable range, the financial statements can become misleading

Indicate whether the statement is true or false

Business

With what type of reduction do companies cut the hours available to each worker but don’t lose any workers?

A. Job hoteling B. Work sharing C. Hours express D. Hourly forecasting E. Absence management

Business

The Taguchi Method suggests that quality should be designed into a product, not inspected into it

Indicate whether the statement is true or false

Business