What are the amount and character of the gain or loss that Jack will recognize during 2017? During 2018?

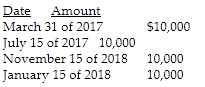

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset). The stock was acquired three years ago. He receives the following distributions as part of a plan of liquidation of Acorn Corporation:

Because Jack's $36,000 basis has not been recovered by the end of 2017, Jack will have no recognized gain in 2017. His unrecovered basis at the end of 2017 is $6,000 ($36,000 - $30,000). He will recognize a $4,000 gain in 2018 ($10,000 - $6,000). The gain will be a long-term capital gain.

You might also like to view...

All of the following are aspects of Trader Joe's customer experience EXCEPT:

A. it offers unusual food products not available from other retailers. B. it has a large and expensive research and development facility. C. it provides rare employee "engagement" to help customers. D. it sets low prices by offering its own brands, not national ones. E. it stocks yuppie-friendly staples on its shelves.

If you saw your friend cheating on a test, you could tell the professor you witnessed the student cheating, but then you might feel guilty for betraying a friend. On the other hand, you could keep quiet, but you might feel bad allowing the cheater to gain an unfair advantage other students in the class. This scenario is an example of a/an ______.

What will be an ideal response?

On average, how much of a report's content should consist of quotations?

A) 10 percent B) 20 percent C) 30 percent D) 40 percent E) 50 percent

A ________ budget is commonly expressed in physical units, and it can be prepared with information including types and capacities of machines, economic quantity, and availability of materials.

A) master B) cash C) capital D) production E) sales