Answer the following statements true (T) or false (F)

1. A cash-basis taxpayer pays a bill with a credit card. The underlying expenditure is not deductible until the credit card bill is paid.

2. If a cash-basis taxpayer gives a note in payment of an expense, the deduction may not be taken until the note is paid.

3. The all-events test requires that the accrual-basis taxpayer report income when all events have occurred that fix the taxpayer's right to the income and when the amount can be determined with reasonable accuracy.

4. Under the accrual method of accounting, the two tests to determine when income must be reported and expenses deducted are the all-events test and the economic performance test.

5. One criterion which will permit a deduction for an expenditure by the accrual-basis taxpayer prior to economic performance is that either the amount is not material or the earlier accrual of the item results in a better matching of income and expense.

1. FALSE

Payment by credit card is considered equivalent to borrowing money to pay the bill so the taxpayer can deduct the expenditure at the time the charge is made.

2. TRUE

The taxpayer cannot take the deduction until the note is paid.

3. TRUE

The question accurately defines the all-events test associated with the accrual method of accounting.

4. TRUE

The two tests for recognition under the accrual method of accounting are the all-events test and the economic performance test.

5. TRUE

There are some exceptions to strict application of the economic performance test, including those involving materiality of the expenditure and the matching principle.

You might also like to view...

April and Cammy are partners who have agreed to admit Elena, who will invest $30,000 for a 20 percent interest. The previous capital balances were $30,000 and $60,000 for April and Cammy, respectively. April and Cammy had shared profits equally. What amount will be recorded in Elena's Capital account?

A) $12,000 credit B) $24,000 credit C) $30,000 credit D) $18,000 credit

Kang Co. reports work in process inventory of $1,085 and cost of goods sold of $56,575. Days' sales in work in process inventory is:

A. 4 days B. 5 days C. 7 days D. 6 days E. 8 days

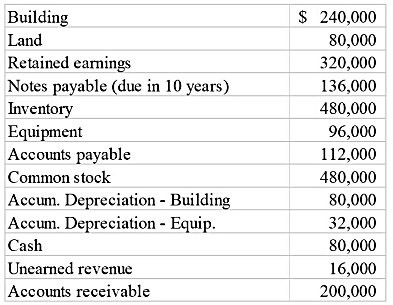

The following is a list of balance sheet accounts (in random order) and balances for Premium Office Supply Company. They have been updated as of December 31, Year 1. Required:Prepare a classified balance sheet for Premium Office Supply Company at December 31, Year 1.

Required:Prepare a classified balance sheet for Premium Office Supply Company at December 31, Year 1.

What will be an ideal response?

Based on the following, what is the total fixed overhead variance for the total production cost flexible budget variance?

A) $650 F B) $425 F C) $350 U D) $725 U