The tax that brings in the most revenue in the United States is the

A. capital gains tax.

B. personal income tax.

C. Social Security tax.

D. corporate income tax.

Answer: B

You might also like to view...

Studies have shown that drinking one glass of red wine per day may help prevent heart disease. Assume this is true, and favorable weather has increased the grape harvest of California vineyards

In the market for red wine, these two developments would A) increase demand and increase supply, resulting in an increase in the equilibrium quantity and an uncertain effect on the equilibrium price of red wine. B) increase demand and increase supply, resulting in an increase in the equilibrium price and an uncertain effect on the equilibrium quantity of red wine. C) increase demand and decrease supply, resulting in an increase in the equilibrium quantity and a decrease in the equilibrium price of red wine. D) increase demand and increase supply, resulting in an increase in both the equilibrium price and the equilibrium quantity of red wine.

The government finances Social Security through

A) excise taxes. B) payroll taxes. C) the sale of goods and services. D) state taxes.

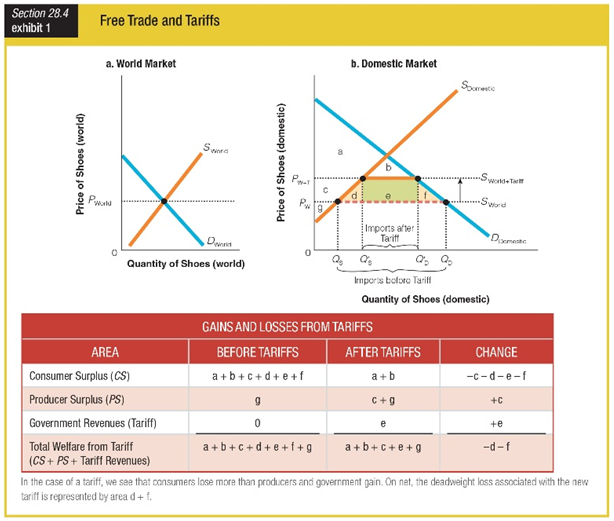

What is the change in total welfare as a result of the tariff on shoes as shown in Exhibit 1?

a. loss of areas d, e, and f

b. loss of areas d and f

c. gain of area e

d. gain of area g

If the equilibrium quantity is equal to the socially optimal quantity, one can infer that:

A. the supply curve for the activity is below the socially optimal supply curve. B. there is a negative externality associated with this good. C. there is no externality associated with this good. D. there is a positive externality associated with this good.