Which of the following is an allowable deduction?

A. Unreimbursed medical expenses that exceed 7.5% of AGI

B. State and local income and property taxes

C. Interest on qualified education loans up to a certain limit

D. All of the answer options are correct.

D. All of the answer options are correct.

You might also like to view...

Robert Lucas has popularized the notion that with respect to

A) severity, business cycles are all alike. B) causation, business cycles are all alike. C) quantitative behavior of co-movements among series, business cycles are all alike. D) qualitative behavior of co-movements among series, business cycles are all alike.

If a policy helps some but harms others

A) the result is a Pareto improvement for the people who are helped. B) then the cost-benefit analysis will show a net increase in surplus and is therefore desirable. C) we cannot use the Pareto principle to evaluate whether or not the policy is desirable. D) it is too hard to determine whether or not the outcome is desirable.

Which of the following is not how economists describe the term "economic rent?:

A. The rental price of a factor of production minus the cost of supplying it. B. The producer surplus in output markets. C. The gains that workers and owners of capital receive from supplying their labor or machinery in factor markets. D. The total revenue that a factor of production earns its owner.

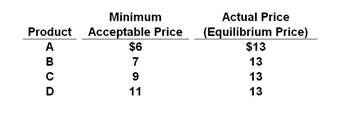

Refer to the table below. If the equilibrium price increases, then the:

A. Producer surplus will decrease

B. Consumer surplus will increase

C. Producer surplus will increase

D. Allocative efficiency will increase