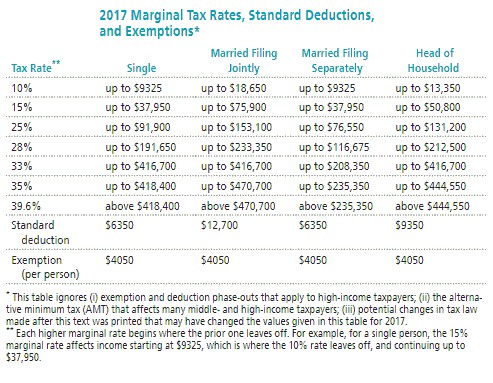

Solve the problem. Refer to the table if necessary. Abbey earned $67,862 in wages. Kathryn earned $67,862, all in dividends and long-term capital gains. Calculate the total tax owed by each, including both FICA and income taxes. Assume they are both single and take the standard deduction. Note that long-term capital gains and dividends are taxed at 0% for income in the 10% and 15% tax brackets and at 15% for income in all higher tax brackets except the highest 39.6% bracket. If necessary, round values to the nearest dollar.

Abbey earned $67,862 in wages. Kathryn earned $67,862, all in dividends and long-term capital gains. Calculate the total tax owed by each, including both FICA and income taxes. Assume they are both single and take the standard deduction. Note that long-term capital gains and dividends are taxed at 0% for income in the 10% and 15% tax brackets and at 15% for income in all higher tax brackets except the highest 39.6% bracket. If necessary, round values to the nearest dollar.

A. Abbey: $15,569

Kathryn: $4878

B. Abbey: $14,531

Kathryn: $8153

C. Abbey: $10,104

Kathryn: $2927

D. Abbey: $15,296

Kathryn: $2927

Answer: D

You might also like to view...

Use the compound interest formula for continuous compounding to determine the accumulated balance after the stated period. A $7000 deposit in an account with an APR of 4.4% compounded continuously for 9 years.

A. $10,313.42 B. $3210.99 C. $10,401.09 D. $7314.88

Determine the indicated term of the given recursively defined sequence.a1 = 4, a2 = 12, ak+2 = ak+1 + 8; a4

A. 12 B. 20 C. 36 D. 28

Express the sum or difference as a product of sines and/or cosines.sin  + sin

+ sin

A. 2 sin (5?)

B. 2 cos (5?) sin ?

C. 2 sin  sin ?

sin ?

D. 2 sin  cos ?

cos ?

Use the commutative law of addition to write an equivalent expression.5 + b

A. 5(1 + b) B. b + 5 C. 5b D. b5