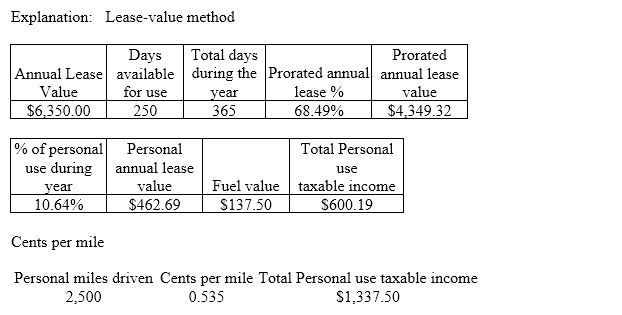

Ronald Ferrer is an employee who drives a 2017 Chevrolet Malibu as a company car. The fair-market value of the car is $23,175. He has been given the choice to have his fringe benefit reported on his W-2 either using the lease-value rule or the cents-per mile rule. According to Publication 15-b, the lease value is $6,350. He has driven 2,500 miles for personal use and 23,500 miles in total during

the year. The car has been available for use on 250 days during the year. Ronald's employer pays for all fuel. What method and valuation will yield the lowest fringe-benefit amount for Ronald? (Do not round intermediate calculations, only round final answer to two decimal points.)

A) Lease-value, $1,337.50

B) Cents-per-mile, $1,337.50

C) Lease-value, $600.19

D) Cents-per-mile, $600.19

C) Lease-value, $600.19

You might also like to view...

Current accounting standards indicate that the costs of intangible assets with an indefinite life, such as goodwill, should

a. not be amortized. b. be reported on the statement of retained earnings in the year in which acquired. c. be amortized over a reasonable period of time not to exceed 40 years. d. increase an expense account entirely in the year in which acquired.

Retailers often end their fiscal years

A) during the slack season. B) during the peak of the busy season. C) at different times each year, depending on the tax consequences. D) on June 30.

Two broad types of franchising arrangements are product/trademark franchising and business format franchising

Indicate whether the statement is true or false

When a firm writes off a bad debt under the allowance method of accounting for bad debts:

a. the realizable value of accounts receivable decreases. b. total net current assets will decrease. c. the Cash account will decrease. d. the realizable value of accounts receivable will not change. e. net income will decrease, expenses will increase.