Too low a level of overbooking will lead to unutilized assets and lost revenue

Indicate whether the statement is true or false.

Answer: TRUE

You might also like to view...

An employment interview is

A) an unstructured dialogue with a representative from a potential employer. B) an easy way for you to learn about the company's operations and markets. C) a formal meeting during which you and the interviewer ask questions and exchange information. D) a session in which the interviewer talks and you listen. E) a well-rehearsed exchange of information between peers.

When plant assets are reported, the current period's depreciation expense is subtracted from the original cost on the balance sheet

a. True b. False Indicate whether the statement is true or false

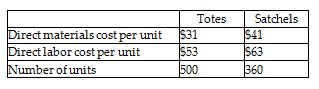

Bag Ladies, Inc. manufactures two kinds of bags—totes and satchels. The company allocates manufacturing overhead using a single plantwide rate with direct labor cost as the allocation base. Estimated overhead costs for the year are $24,500. Additional estimated information is given below.

Calculate the amount of overhead to be allocated to Totes. (Round any percentages to two decimal places and your final answer to the nearest dollar.)

A) $462

B) $333

C) $11,299

D) $13,202

Hargett Incorporated makes a single product--an electrical motor used in many long-haul trucks. The company has a standard cost system in which it applies overhead to this product based on the standard machine-hours allowed for the actual output of the period. Data concerning the most recent year appear below:?Budgeted (Planned) Overhead:???Budgeted variable manufacturing overhead$45,450??Budgeted fixed manufacturing overhead265,050??Total budgeted manufacturing overhead$310,500??????Budgeted production (a)30,000units?Standard hours per unit (b)1.50machine-hours?Budgeted hours (a) × (b)45,000machine-hours?????Applying Overhead:???Actual production (a)34,000units?Standard hours per unit (b)1.50machine-hours?Standard hours allowed for the

actual production (a) × (b)51,000machine-hours?????Actual Overhead and Hours:???Actual variable manufacturing overhead$68,110??Actual fixed manufacturing overhead255,050??Total actual manufacturing overhead$323,160??Actual hours49,000machine-hoursRequired:a. Determine the variable overhead rate variance for the year.b. Determine the variable overhead efficiency variance for the year.c. Determine the fixed overhead budget variance for the year.d. Determine the fixed overhead volume variance for the year.e. Determine whether overhead was underapplied or overapplied for the year and by how much. What will be an ideal response?