If a $500 tax is placed legally (statutorily) on the buyers of new couches and as a result the price of couches at stores rises by $200, the actual burden of the tax

a. falls completely on couch buyers.

b. falls completely on couch sellers.

c. is $200 on couch buyers and $300 on sellers.

d. is $300 on couch buyers and $200 on sellers.

C

You might also like to view...

The term structure relationships regarding different interest rates approximately reflect expected exchange rate changes

Indicate whether the statement is true or false

Assume the price of pizza decreases. As a result, your real income increases and you increase the quantity of pizza purchased each month. This is an example of the:

a. substitution effect. b. income effect. c. revenue effect. d. consumer price effect.

The Phillips curve explains the trade-off between inflation and unemployment

a. True b. False Indicate whether the statement is true or false

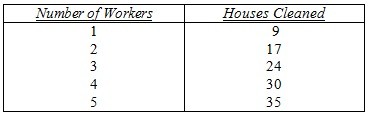

A housecleaning company receives $25 for each house cleaned. The table below gives the relation between the number of workers and the number of houses that can be cleaned per week.  Based on the above info, if the wage rate of a housecleaner is $130, what is the maximum amount of profit the company can earn?

Based on the above info, if the wage rate of a housecleaner is $130, what is the maximum amount of profit the company can earn?

A. $750 B. $230 C. $150 D. $ 20 E. none of the above