When a tax is placed on the sellers of a product, the

a. size of the market decreases.

b. effective price received by sellers decreases, and the price paid by buyers increases.

c. supply of the product decreases.

d. All of the above are correct.

d

You might also like to view...

One way to differentiate products that are similar to each other is to offer _______________, such as free shipping or a rebate.

a. ephemeral benefits b. unquantifiable aspects c. transient benefits d. intangible aspects

The concept of economies of scope describes the savings acquired from simultaneous production of different products

a. True b. False Indicate whether the statement is true or false

One criticism of the unemployment rate is that it

A. does not include the number of discouraged workers as unemployed. B. counts a new entrant that is actively seeking work as unemployed. C. does not include people who are not working and are not looking for work. D. is a stock measure.

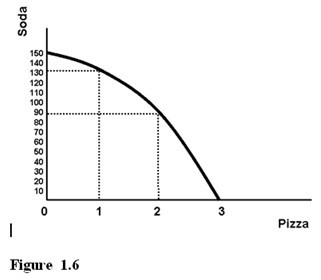

Using Figure 1.6, we know the production of 90 units of soda and 2 units of pizza is

A. impossible because we have the technology but do not have the resources. B. possible, but only if all resources were fully employed. C. possible, but there would be unemployed resources. D. impossible because we have the resources but do not have the technology.