Employers may be liable for torts of employees that can be attributed to negligent hiring or supervision under the rule of law known as:

a. contractor liability b. tortious liabilitius

c. respondeat superior d. principal duty

e. there is no such rule as the employee only is responsible

c

You might also like to view...

Which of the following allows a business the potential to own the market until other competitors venture to enter?

A) a decentralization strategy B) the cluster effect C) a low barrier to entry D) a first-mover advantage E) a network effect

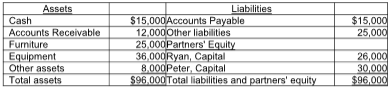

Ryan and Peter share profits in the ratio 3:2. They have decided to liquidate the partnership. After completing all the liquidation procedures (assuming all assets and liabilities were liquidated at book value), the business is left with $56,000 cash. As a result, Ryan will receive ________.

The balance sheet of Ryan and Peter's partnership as of December 31, 2018, is given below.

A) $26,000

B) $30,000

C) $56,000

D) $36,000

Issues management is more reactive than standard crisis management

Indicate whether the statement is true or false

Presented below are the financial balances for the Boxwood Company and the Tranz Company as of December 31, 2017, immediately before Boxwood acquired Tranz. Also included are the fair values for Tranz Company's net assets at that date. Boxwood Tranz Co. Tranz Co.?(all amounts in thousands) Book value Book value Fair value 12/31/2017 12/31/2017 12/31/2017Cash$870 $240 $240 Receivables 660 600 600 Inventory 1,230 420 580 Land 1,800 260 250 Buildings (net) 1,800 540 650 Equipment (net) 660 380 400 Accounts payable (570) (240) (240)Accrued expenses (270) (60) (60)Long-term liabilities (2,700) (1,020) (1,120)Common stock ($20 par) (1,980) Common stock ($5

par) (420) Additional paid-in capital (210) (180) Retained earnings (1,170) (480) Revenues (2,880) (660) Expenses 2,760 620 ??Note: Parenthesis indicate a credit balance??Assume a business combination took place at December 31, 2017. Boxwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Tranz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Tranz's fair value, Boxwood promises to pay an additional $5.2 (in thousands) to the former owners if Tranz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands).?Compute consolidated revenues immediately following the acquisition. A. $1,170. B. $3,540. C. $4,050. D. $2,880. E. $1,650.