A theory of fairness that holds that taxpayers should contribute to the government in proportion to the benefits they receive from public expenditures is the

A. benefits-received principle.

B. equality-for-all principle.

C. equity principle.

D. ability-to-pay principle.

Answer: A

You might also like to view...

When people expect higher inflation, usually nominal interest rates will:

A. rise. B. fall. C. remain unchanged. D. move erratically.

To derive the law of demand, we assume that

A. marginal utility is constant. B. prices are constant. C. tastes are constant. D. real prices are constant.

What happens in the secondary market?

A) secondary inputs like electricity are sold B) a corporate financial manager will raise funds for expansion of the firm C) newly issued claims are sold by the borrowing firm to the initial buyer D) already issued claims are sold from one investor to another

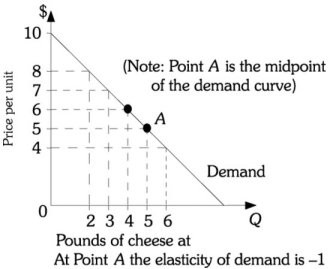

Refer to the information provided in Figure 13.2 below to answer the question(s) that follow.  Figure 13.2 Refer to Figure 13.2. The marginal revenue of the fourth pound of cheese is

Figure 13.2 Refer to Figure 13.2. The marginal revenue of the fourth pound of cheese is

A. $1. B. $3. C. $6. D. $24.