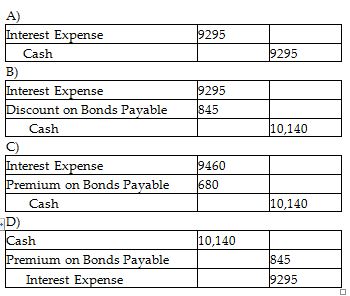

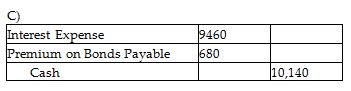

On January 1, 2019, Castle Services issued $169,000 of six-year, 12% bonds when the market interest rate was 11%. The bonds were issued for $172,000. Castle uses the effective-interest method to amortize the bond premium. Semiannual interest payments are made on June 30 and December 31 of each year. Which of the following is the correct journal entry to record the first interest payment? (Round your answers to the nearest dollar number.)

Explanation: Interest Expense = $172,000 × 11% × 6/12 = $9460

Cash paid = $169,000 × 12% × 6/12 = 10,140

You might also like to view...

What practice involves the analysis of various financial ratios?

A. financial analysis B. financial accounting C. financial management D. managerial accounting

Which of the following statements is(are) false?(A) Operations costing accounts for material costs like job costing and conversion costs like process costing.(B) An automobile manufacturer is more likely to use an operations costing system than a process costing system.

A. Only A is false. B. Only B is false. C. Both of these are false. D. Neither of these is false.

Which phase of appreciative inquiry “asks what is the world asking us to become?”

a. Discovery b. Dream c. Design d. Destiny

The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1: Cash$1400? Accounts Receivable$950? Dividends 700? Common Stock 1175? Land 1000? Revenue 1000? Accounts Payable 550? Expense 650? Retained earnings 1975? What is the amount of total assets that will be reported on the balance sheet as of December 31, Year 1?

A. $3350. B. $4350. C. $4050. D. $2400.