________ made illegal every conspiracy in restraint of trade or commerce among the several states.

A. The Clayton Act

B. The FTC Act

C. The Humphrey-Hawkins Act

D. The Sherman Antitrust Act

Answer: D

You might also like to view...

According to this Application, economists have found that the fiscal multiplier is ________ during slack times

A) sometimes larger B) always larger C) always smaller D) none of the above

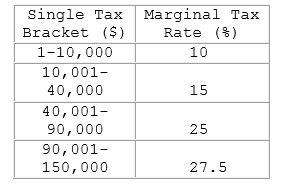

For a person earning $75,000, the average tax rate is:

A. 10%

B. 15%

C. 19%

D. 17%

The cross elasticity between two goods is 2.5 . These goods are

a. perfect complements b. imperfect complements c. unrelated d. substitutes e. inferior

A corrective tax is intended to: a. cover the costs of negative externalities

b. increase the private benefits of consumption. c. increase the deadweight loss caused by negative externalities. d. increase the deadweight loss caused by positive externalities.