Before licensing a particular software package, the company should test the system using _____, which is comparing actual performance against specific quantifiable criteria.

Fill in the blank(s) with the appropriate word(s).

benchmarking

You might also like to view...

When determining a design strategy for your résumé, what considerations should influence your design decision?

A) The audience, your goals, and your resources B) Your goals, your resources, and current trends C) Your headings, your embedded links, and your audience D) The resources of the organization, the applicant tracking system used, and your field of expertise E) The audience, included data and availability of infographics

Hospitality employees are different from manufacturing employees; in addition to task skills, they must have ______.

a. an understanding of basic culinary principles b. extensive experience c. a warm personality d. interpersonal and problem-solving skills

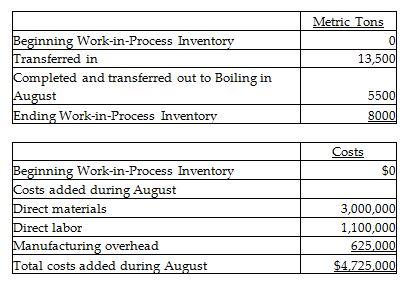

Azucar, Inc. has six processing departments for refining sugar—Affination, Carbonation, Decolorization, Boiling, Recovery, and Packaging. Conversion costs are added evenly throughout each process. Data from August for the Decolorization Department are as follows:

The ending Work-in-Process Inventory is 100% and 75% complete with respect to direct materials and conversion costs, respectively. The weighted-average method is used. Compute the cost per equivalent unit for direct materials and conversion costs. (Round any intermediate calculations and your final answer to two decimal places.)

A) $222.22 per metric ton for direct materials; $222.22 per metric ton for conversion costs

B) $81.48 per metric ton for direct materials; $200.00 per metric ton for conversion costs

C) $200.00 per metric ton for direct materials; $81.48 per metric ton for conversion costs

D) $222.22 per metric ton for direct materials; $150.00 per metric ton for conversion costs

The portion of a group purchase of land and building for $1,302,000 allocated to land, when the land is appraised at $340,000 and the building on the land is appraised at $1,020,000, is

A) $996,500. B) $325,500. C) $345,500. D) $976,500.