Suppose Mishka buys 15 apples per month her total tax burden from a $3 per apple tax is $100 every month.

A. Her excess burden is $45.

B. Her excess burden is $6.67 per apple.

C. Her excess burden is greater than her taxes paid.

D. Her taxes paid are greater than her tax burden.

Answer: B

You might also like to view...

Increases in ________ typically lead to decreases in consumption

A) the interest rate B) disposable income C) autonomous consumption D) all of the above E) none of the above

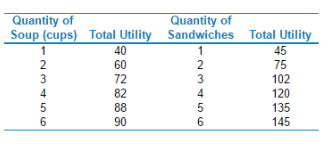

The table to the right shows Keira's utility from soup and sandwiches. The price of soup is $2 per cup and the price of a sandwich is $3. Keira has $18 to spend on these two goods. What is Keira's marginal utility per dollar spent on the third cup of soup?

A) 72 units of utility

B) 36 units of utility

C) 12 units of utility

D) 6 units of utility

In an economy at full employment, a presidential candidate proposes cutting the government debt in half in four years by increasing income tax rates and reducing government expenditures. According to Keynesian theory, implementation of these policies is most likely to increase

A) unemployment B) consumer prices C) aggregate demand D) aggregate supply E) the rate of economic growth

Which of the following is a positive statement?

A) We need to carefully protect our borders. B) Inflation is the most damaging thing that can occur in an economy. C) When tax revenues are less than government spending there is a budget deficit. D) Foreign aid should be reduced to help reduce the national debt.