What is the dominant strategy for Bob? Donna? Which strategy should each player choose to maximize the potential gain? What do you think the outcome of this game will be? Carefully explain your answers

What will be an ideal response?

The dominant strategy for Bob is to cheat; either he profits by $16,000 (if Donna agrees) or he profits by $4,000 (if Donna also cheats). The alternative of agreeing could profit him by $10,000 (if Donna also agrees), but it could also cause him to lose $4,000 (if Donna cheats). The dominant strategy for Donna is to cheat; either she profits by $16,000 (if Bob agrees) or she profits by $4,000 (if Bob also cheats). The alternative of agreeing could profit her by $10,000 (if Bob also agrees), but it could also cause her to lose $4,000 (if Bob cheats). If Bob thinks Donna will cheat, he should cheat because the potential payoff is greater. If Donna thinks Bob will cheat, she should cheat because the potential payoff is greater. The maximin strategy for both Bob and Donna would be to cheat. If each cheats, their individual profits will be $4,000 .

You might also like to view...

The expansion of 2002 and beyond was due, at least in part to

a. interest rate increases. b. increases in housing wealth. c. increases in investment spending. d. large reductions in federal spending. e. increases in taxes.

The phenomenon of overshooting is based on the existence of

A. irrational investor behavior. B. perfectly competitive global markets and flexible prices. C. covered interest parity. D. sticky prices and the belief that purchasing power parity(PPP) and the monetary approach hold in the long run.

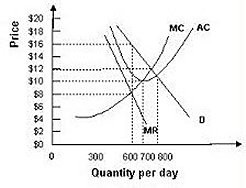

For the monopoly in the above figure, if the firm is currently producing 700 units, which of the following is correct?

For the monopoly in the above figure, if the firm is currently producing 700 units, which of the following is correct?

A. It is maximizing its profits. B. It is incurring a loss. C. It could earn higher profits if it produced more units each day. D. It could earn higher profits if it produced fewer units each day.

Table 3 Hometown Bank Assets Liabilities Reserves $25,000 Deposits $150,000 Loans $125,000 Refer to Table 3. If the reserve requirement is 25 percent, this bank

A. has $10,000 of excess reserves. B. needs $12,500 more reserves to meet its reserve requirements. C. needs $2,500 more reserves to meet its reserve requirements. D. just meets its reserve requirement.