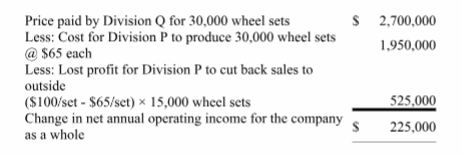

Division P of Launch Corporation has the capacity for making 75,000 wheel sets per year and regularly sells 60,000 each year on the outside market. The regular sales price is $100 per wheel set, and the variable production cost per unit is $65. Division Q of Launch Corporation currently buys 30,000 wheel sets (of the kind made by Division P) yearly from an outside supplier at a price of $90 per wheel set. If Division Q were to buy the 30,000 wheel sets it needs annually from Division P at $87 per wheel set, the change in annual net operating income for the company as a whole, compared to what it is currently, would be:

A) $600,000

B) $225,000

C) $750,000

D) $135,000

E) $700,000

B) $225,000

You might also like to view...

The auditor performs substantive procedures related to property, plant and equipment to determine if the assets have been pledged as collateral or title has transferred. What is the primary assertion the auditor is testing?

a. Valuation. b. Rights. c. Completeness. d. Existence.

An example of a firm's use of a different set of accounting principles for financial reporting and for income tax reporting is

a. the allowance method for financial reporting and the direct write-off method for income tax reporting. b. the direct write-off method for financial reporting and the allowance method for income tax reporting. c. the direct write-off method for financial reporting and the percentage of sales method for income tax reporting. d. the allowance method for financial reporting and the percentage of payables method for income tax reporting. e. none of the above.

Which of the following is a feature of qualitative research in primary data collection?

A. It asks yes or no type questions. B. It uses statistics to analyze data. C. It relies on open-ended questioning. D. It asks closed-ended questions. E. It provides more representative samples of consumers.

The maximum value of a target firm to the buyer = the value to the seller - the value added by the buyer

Indicate whether the statement is true or false