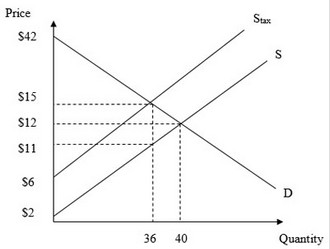

Use the figure below to answer the following question. What is the amount of producer surplus after the government imposes the excise tax on the market?

What is the amount of producer surplus after the government imposes the excise tax on the market?

A. $162

B. $540

C. $486

D. $180

Answer: A

You might also like to view...

Suppose a deposit in New York earns 6 percent a year and a deposit in London earns 4 percent a year. Interest rate parity holds if the

A) U.S. dollar appreciates by 2 percent a year. B) U.S. dollar depreciates by 2 percent a year. C) U.K. pound depreciates by 2 percent a year. D) None of the above answers is correct because interest rate parity requires that the interest rates be the same in both countries.

Suppose business decision makers become more optimistic about the future and, as a result, increase their investment spending by $20 billion. If the economy's marginal propensity to consume is 0.75, the equilibrium level of aggregate real GDP will increase by:

a. $15 billion. b. $20 billion. c. $50 billion. d. $80 billion.

When the government raises revenue by printing money, it imposes an "inflation tax" because the:

A. real value of money holdings falls. B. interest rate falls. C. difference between nominal and real interest rates becomes smaller. D. nominal value of money holdings falls.

Refer to Scenario 7.5 below to answer the question(s) that follow.SCENARIO 7.5: You own and are the only employee of a company that customizes bicycles. Last year your total revenue was $60,000. Your costs for rent and supplies were $25,000. To start this business you invested an amount of your own capital that could pay you a $45,000 a year return.Refer to Scenario 7.5. During the year your economic costs were

A. $25,000. B. $35,000. C. $45,000. D. $70,000.